In these days of

advanced technology, e-payment process has become quite common. It helps to

make the transactions easy with the help of an electronic medium. Using this

technology, you need not have to carry any cash or checks in order to pay for

any service or goods. This electronic payment system or online payment system

is one of the best and convenient these days.

Now you must be

wondering about the security of the same. To add more to your surprise, there

are certain service providers whom you can rely upon. They shall help you with

a complete secured transaction. Getting any secured transaction service for any

business organization is important for the overall smooth functioning of the

payment process. One such service provider is AppStar Financial. With the increased, improved and secured mode of

online payment, it is sure to decrease the use of cash and checks.

Elaborating About Forms Of Online Payment

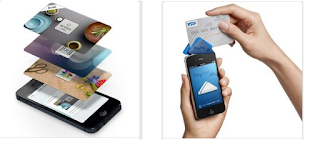

There are two forms of

online payment namely credit and debit payment. There are other alternative

modes of payments as well such as electronic wallets that make use of various

applications, bank transfer, smart cards or Bitcoins. Again, among the

e-payment method, there are two board categories namely cash payment and credit

payment. To get the best service ever, you can easily seek help from AppStar Financial to get through all

these secured modes of payments. After you assign them the required task, you

can completely rely on them. Even if you check the past review of the service

providers, you will get to know more about the service providers. To get the

secured service for your business organization, approaching this service

provider would be a wise decision.

Advantages And Disadvantages Of Using Online Payment

As the first advantage,

it can be said that the online mode of payment is convenient, effective and

easier to add money to any website. On a different note, if you look into

drawbacks of online payments, then you might be worried about the level of

security involved in the same. Also, if the internet connection fails, you are

unable to carry out the payment process.

Comments

Post a Comment